In July 2025, three gold pours were made at Madsen, producing a total of 3,800 ounces of gold. Of that, 3,595 ounces were sold at an average price of US$3,320 per oz, which generated CND $16.4 million in revenue.

Vancouver, BC, August 7, 2025 – Global Stocks News – Sponsored content disseminated on behalf of West Red Lake Gold. On August 6, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) provided an update on ramp-up activities at the Madsen Mine in Red Lake, Ontario.

In July 2025, three gold pours were made at Madsen, producing a total of 3,800 ounces of gold. Of that, 3,595 ounces were sold at an average price of US$3,320 per oz, which generated CND $16.4 million in revenue.

The company currently has a dual focus: 1. Achieving targeted ramp-up gold ounce production, 2. Instituting new operational efficiencies.

“July was a good month for Madsen and our mine operations team,” stated Shane Williams, WRLG President and CEO. “Mine ramp-up is about adding equipment, developing access to high-priority mining areas, and increasing operational efficiency until the mine consistently produces the targeted daily tonnage at the targeted grade.”

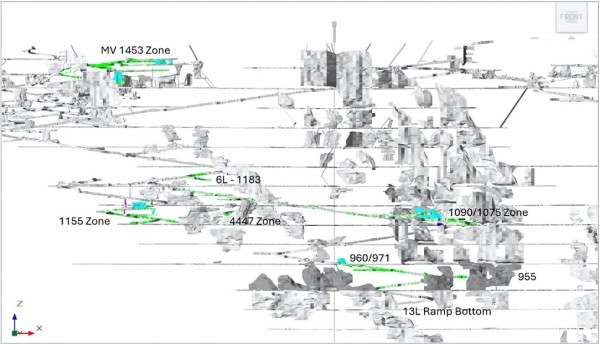

In July the Madsen mine operations team completed sill development and mining in eight (8) areas spread across McVeigh, South Austin, and Austin. Mined material carried an average grade of 8.9 grams per tonne gold.

Figure 1. Long section of the Madsen Mine showing the eight areas of active mining, sill development, and access development through the month of July 2025.

“Our continued operational success through bulk sample and now ramp-up demonstrates that we understand the geology and how to mine the orebody,” Maurice Mostert, WRLG VP of Technical Services told Guy Bennett, CEO of Global Stocks News (GSN). “As a company, we are conservative by nature. With our density of drilling, we’ve mitigated risk significantly.”

“In numerous cases, where we’ve expected to find the edge of a zone, further drilling has grown that zone,” continued Mostert. “That means we don’t have to urgently develop to a new area to reach our ounce-production goals. The mineralisation is right in our existing backyard.”

“We are not in full commercial production yet,” added Mostert. “The mill is permitted for 800 tonnes per day, but we are still ramping up to that target. On the days of lower production, we are doing maintenance on the mill. In full commercial production, we anticipate steady mill performance.”

Stope areas at Madsen are drill tested to 7-metre spacing. Sills, which are the access levels developed above and below stopes to create access to the mine, are not always drilled to 7-metre spacing because of stope and drill bay geometry.

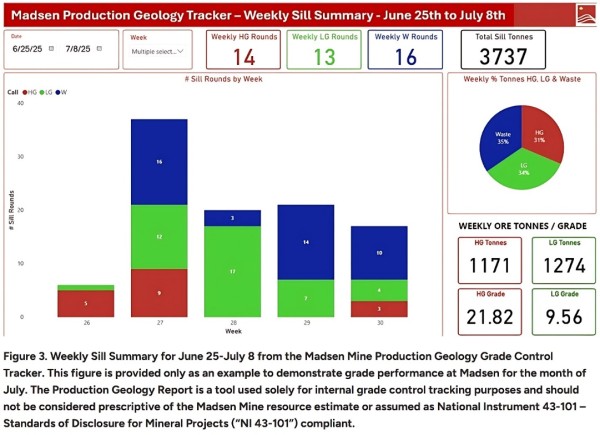

“In July we saw the short-term resource model doing its job: stope grades reconciled closely to predicted model grades, and in fact exceeded planned grades in many cases,” said Jill Christmann, Madsen Mine Chief Geologist.

In addition, chip sampling along sills adds data to the model before stopes are mined. As a result of these two factors, sills are expected to return higher grade variability versus the model than stopes.

Such variability is shown in the figure below, which shows the number of sill development rounds that were expected to generate high grade (red), low grade (green), and waste (blue) material and the actual grades achieved for each kind of material.

WRLG is working on two projects to support further mine ramp-up and operational stability for the balance of the year.

Shaft Renovation

To prepare the Madsen Shaft to return to skipping material, West Red Lake Gold developed a 3-stage plan, with stage 1 to be implemented by year-end.

“The ‘skipped material’ is brought up the shaft in a big bucket called ‘the skip’,” Mostert told GSN. “Transporting material this way reduces costs and saves time, because you don’t have to drive the material up through the network of underground tunnels, from level 12 to surface.”

To achieve stage 1 skipping the company purchased a new hoist rope, a 5-tonne skip, and scrolls. Once phase 1 is complete with this new equipment, the shaft will be able to move approximately 300-400 tonnes of material to surface a day. These tonnes will be additive to the current material moving capacity.

Cemented Rock Fill (CRF) Project

Ore and waste must both be moved in a mine. The less waste that must be brought to surface, the better for a mine’s costs and efficiency.

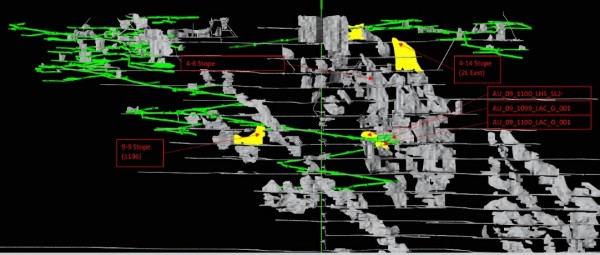

Most historic stopes at Madsen are backfilled, but there are also a number of large empty stopes. These voids are ideal repositories for waste rock. To utilize such voids effectively, waste rock must be turned into Cemented Rock Fill (CRF).

“To restore the geotechnical strength of excavated stopes, we take broken rock and put it back to solidify the structures,” Mostert told GSN. “With CRF, you cure the loose rock with a cement binder content. The intended result is that you can eventually mine very close to the filled stope.”

Moving waste rock from where it is generated underground to these voids, rather than to surface, will free up significant haulage capacity.

Figure 5. A long section of the Madsen Mine showing historic mining. Remnant open stopes that West Red Lake Gold has identified as potentially suited for CRF waste rock storage are highlighted in yellow.

“Mine ramp ups are always balancing two competing needs: producing planned ounces in a given month and developing to ensure the ability to continue producing planned ounces in the months ahead,” said Williams. “Positive surprises, like the high-grade sills we encountered several times in July, make it easier to achieve that balance. July therefore helped set us up for success in the coming months.

The mine plan in the Madsen Mine Pre-Feasibility Study (PFS) [1] used a gold price of US$1,680 per oz – about 50% of the current gold price. This led to a mine plan with 60% of the mining being small, high-grade stopes requiring the use of cut-and-fill mining, which is selective and relatively high cost. [2]

For its current mine design, West Red Lake Gold is using the “consensus long-term price” of US$2,350 per ounce – a conservative number about $1,000 per ounce below the current gold price.

The technical information presented in this release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, and by Maurice Mostert, P.Eng., Vice President of Technical Services Maurice for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

References:

1. Please refer to the technical report entitled “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

2. See PFS Section 16.5.3 Mining Methods – Underground Mining Methods – Planned Mining Methods.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:32056

The post West Red Lake Gold Generates July Gold Sales of CND $164 Million in Madsen Mine Ramp-up Phase appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section